B2B SaaS Pricing Models

Tiered pricing

The tiered pricing model is made up of a series of plans or ‘levels’ with escalating price points. Customers choose the plan that best suits their needs, paying more depending on the volume of features/functionality/customer support required.

How many tiers should you have? The sweet spot is usually between 3 and 4, although it’s not uncommon for companies to offer up to 6 (our SaaS products – Coupler.io & Mailtrap – have 4 and 6 tiers respectively). In short, the ideal number will vary depending on your service offering and competition. But to avoid confusing your customers, don’t go higher than 6.

Note: Tiers are also a common feature of other pricing models – you’ll spot them in most of the examples we discuss in this article.

Advantages

- Allows companies to cater to different customer segments with varying needs and budgets, which leads to increased revenue.

- Easier to acquire new customers due to the variety of plans on offer.

- Improves customer retention as users can upgrade/downgrade depending on their needs.

Disadvantages

- Consumes more resources (development, customer support) to manage multiple plans.

- Tiers add a layer of complexity to pricing, which can confuse potential customers.

- Having too many tiers can cause decision paralysis among potential customers.

Example

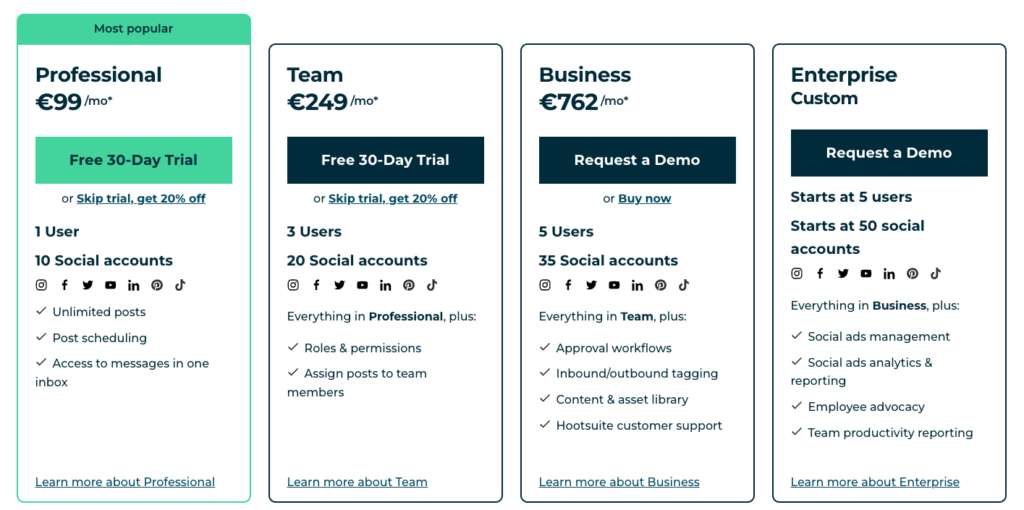

Hootsuite’s model is a classic example of tiered pricing. Each tier caters to a different segment of their target audience – from the freelance content creator to the growing or well-established business.

Per-user pricing

Per-user pricing is a common B2B SaaS pricing model where businesses are charged based on how many of their employees use the software. Recent research suggests that it’s one of the most widely-adopted pricing models among SaaS companies (alongside usage-based pricing).

Advantages

- Attractive to businesses who need a scalable solution.

- Transparent pricing model that allows potential customers to quickly estimate their costs.

- Easy for customers to justify subscription costs as they only pay for the number of employees who use the software. Additionally, when exploring micro SaaS ideas, incorporating a per-user pricing model can be advantageous for scalability and customer budget considerations.

Disadvantages

- There’s a chance that some businesses will share accounts (particularly for design/marketing tools) instead of buying more seats, which makes it harder for you to grow your user base and predict revenue.

- Can lead to higher churn rates if a large percentage of your customer are startups. Fast-growing companies may not want to deal with subscription costs that rise every week/month.

- Easy for competitors to beat your pricing by offering deals on batches of seats (e.g. you charge $25 per user but your competitor now offers 10 seats for $150).

Example

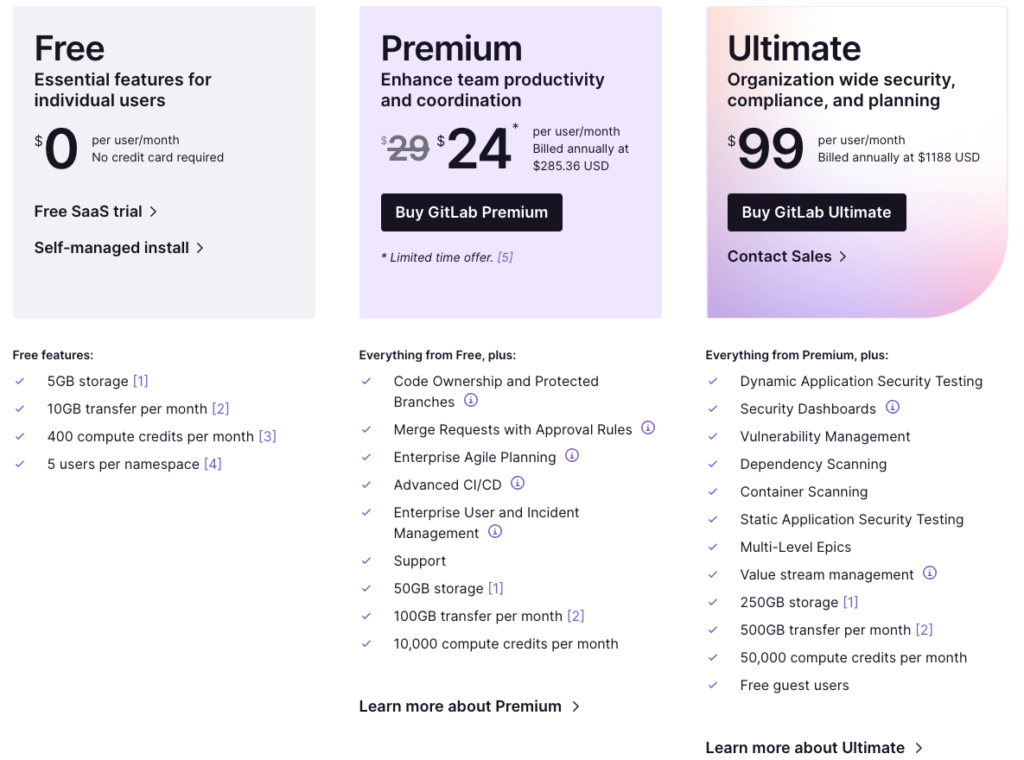

Google Workspace, Figma, Atlassian, and Slack are just a few of the B2B SaaS giants that employ per-user pricing. Here’s Gitlab’s pricing page as a typical example.

Usage-based pricing

Otherwise known as pay-as-you-go, usage-based pricing is where customers only pay for what they consume. The more data/features they use, the higher the cost of their subscription. According to a 2022 survey by Openview Partners, 3 out of 5 SaaS companies “now use some form of usage-based pricing.” It’s considered a good fit for products that are highly technical or sell data processing/storage services. At software agency Railsware, both of our B2B SaaS products – Mailtrap and Coupler.io – employ a usage-based pricing model.

Advantages

- Increased likelihood that customers will upgrade to more expensive plans (as their team grows, so does their consumption)

- Can provide a competitive advantage by attracting customers who are looking for more flexible and transparent pricing options.

- Improves customer retention since the price is aligned with customer needs.

Disadvantages

- Trickier to design and implement than other types of pricing models.

- Requires a deep understanding of how customers use your product so that the correct limits/baselines can be set.

- Potential customers might struggle to assess their own usage needs; you’ll need to engage with them more directly before the sale (e.g scheduling calls to discuss each customer’s individual needs).

Example

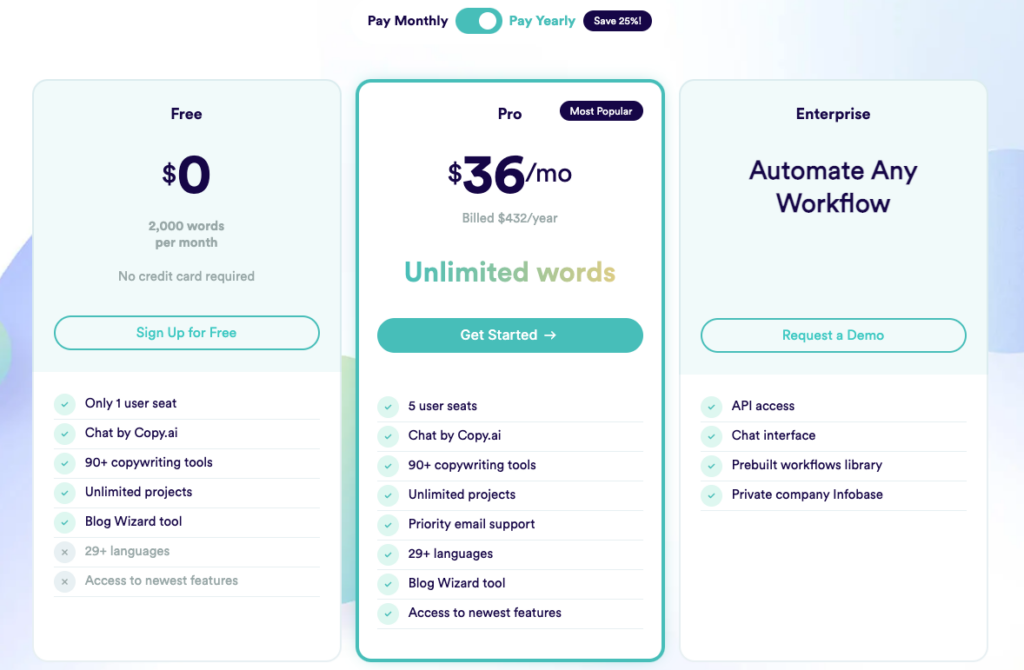

Copy.ai is a basic example of an enterprise who built their artificial intelligence product around the pay-as-you-go model. Customers can generate $2K words free per month, but if their needs stretch beyond that limit, they must upgrade to the paid plans.

Flat-rate pricing

Flat-rate pricing is one of the least popular B2B SaaS pricing models. However, it’s also the simplest. Instead of comparing plans or evaluating team needs, customers pay a fixed fee (monthly or annually) and get access to all features/functionality. In some instances, they might pay extra for add-ons.

Advantages

- It’s straightforward. There’s no risk of confusing or overwhelming potential customers with a complex range of plans.

- Easier to predict revenue as every customer pays the same each billing cycle.

- Easier to manage and maintain than other models (no need to track usage or multiple tiers).

Disadvantages

- You miss out on potential revenue from customers who are ready to pay more for additional features or usage.

- Businesses looking for scalable plans may be turned off by the lack of choice.

Example

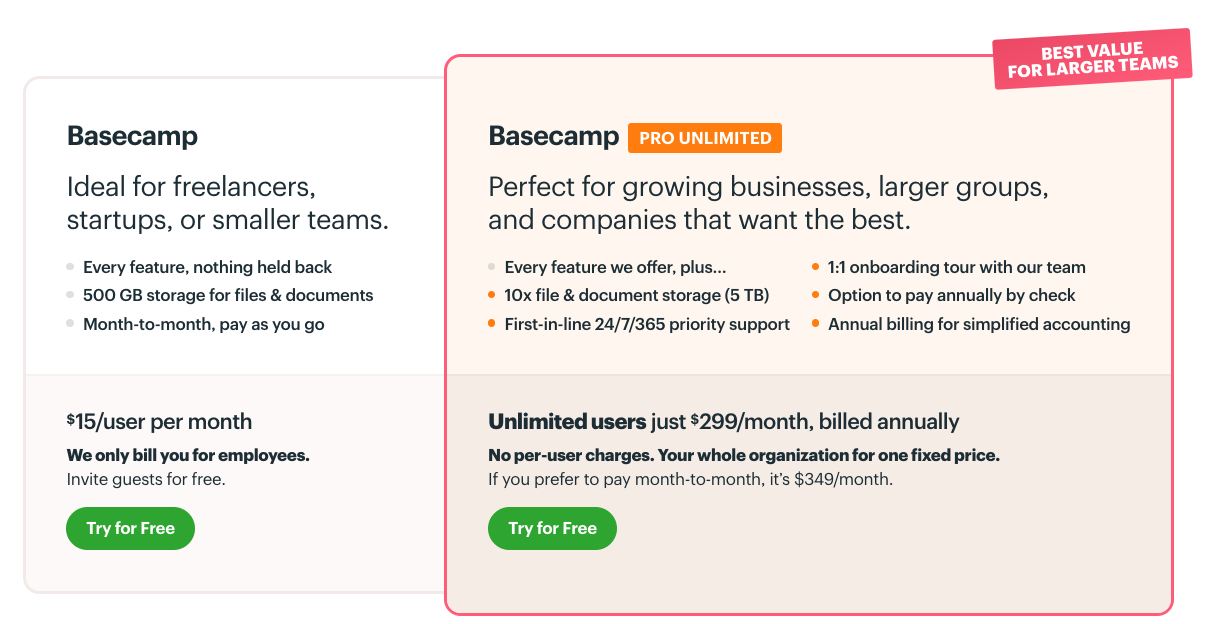

It’s hard to find a B2B SaaS company that uses flat-rate pricing nowadays, but Basecamp is probably the best-known. Technically, they offer 2 plans – one for smaller teams, and one for larger enterprises. But the main $299 fixed fee plan is still unusual, especially when compared to Basecamp competitors like the pricing structures of ClickUp or Monday.com, who all employ the standard per-user model.

. . .

The above list accounts for the most popular pricing models in the B2B SaaS market. But there are a couple of other models worth mentioning: Per active user pricing & per feature pricing. The former is a variant of the per-user model, where customers only pay for the number of employees who use the product on a regular basis (daily, or X number of times per week). Meanwhile, with per-feature pricing, users pay only for the number of features they actually engage with.

Popular Pricing Strategies

Value-based pricing

The traditional way of pricing products is to base prices on production costs. But what if your product’s worth exceeds that? What if it solves a problem that no one else has been able to solve, or provides a truly unique benefit? As David Cancel, CEO and founder of Drift said: “People not caring enough about your product is your true competition, not some other startup.”

The value-based pricing strategy takes those factors into account. You can set a price that reflects the value your product provides to the customer. And if the value increases (new features, improved functionality, better customer support), so should your prices.

Bear in mind, though, that value-based pricing takes quite a bit of work to implement. You’ll need more than just market research and competitor analyses to determine the product’s value. You need to actually meet with your potential customers, show them a demo, understand what they think your product is worth, and create price points that align with those findings. So, make customer development interviews an integral part of the process.

Cost–plus pricing

Cost-plus pricing is what we were referring to as the ‘traditional’ or old-school way of pricing products. Here, companies calculate how much the product cost to build and add a markup to that number (if it costs them $100 dollars to build a digital watch, the company makes a profit by adding 20% on top).

Cost-plus pricing works well for hardware manufacturers but it’s not the best option for SaaS products. Firstly, there are lots of complex factors to consider when calculating the total cost: server hosting fees, employee salaries, software development costs, and marketing expenses to launch advertising or take into account the costs of the ad server if you prefer to manage optimized advertising through this software.

The performance and reliability of your hosting directly impact operational expenses, while scalable options help manage growth without unexpected cost spikes. Choosing the right Magento Hosting can also affect these costs and should be carefully evaluated when setting prices.

Secondly, price points developed with this strategy only reflect production costs, not what customers are willing to pay for your service.

Competitor-based pricing

Competitor-based pricing is about analyzing the prices of similar products on the market and then setting a price that is either lower, higher, or equal to your competitor’s prices. It’s a low-risk strategy for a few reasons: 1. Provides a benchmark to prevent you from under/overcharging 2. Helps you set competitive price points 3. Requires less of a time/money investment (cost of running CustDev, extensive market research) than other strategies.

Although it’s essential to have competitive pricing, imitating competitors’ models is not always the best strategy. You can’t assume your competitors know what the market is willing to pay, and your product may have significant differences from other market alternatives. It’s better to concentrate on enhancing your value proposition instead of solely trying to match industry standard prices.

Penetration pricing

Penetration pricing is about launching your product at a price point that is lower than your competitors. The goal is to gain a competitive advantage by attracting as many new users as possible to your platform.

Many startups jump on this strategy because it seems like a quick way to gain early adopters. But it’s far from foolproof. There’s a chance that potential customers could perceive your product as being ‘cheap’ and avoid it completely. It’s also not a solid long-term strategy, as it will be difficult to offset costs and grow your product without charging a competitive price.

Still in the early stages of product development? Refer to our guides on startup frameworks and startup metrics for advice on how to shape your overall product strategy.

. . .

Many B2B SaaS companies leverage hybrid pricing models and blended strategies these days. They combine tiers with other elements like usage-based models or per-user models and take a value-based approach while also adding freemium.

Remember, you don’t need to stick to just one model when designing your pricing structure. As we’ll discuss later, most startups try to play it safe by copying their competitors’ pricing pages. But if you want to create a sustainable pricing model, you need to understand your customers’ needs – not just your competitors’ interpretation of them. We recommend using tried-and-tested product management frameworks to develop a holistic picture of your ideal customer(s).

How we monetized our B2B SaaS products

Our teams have plenty of hands-on experience with B2B SaaS monetization. Here we’ll give some insight into how as software agency we’ve iterated on our pricing over the years.

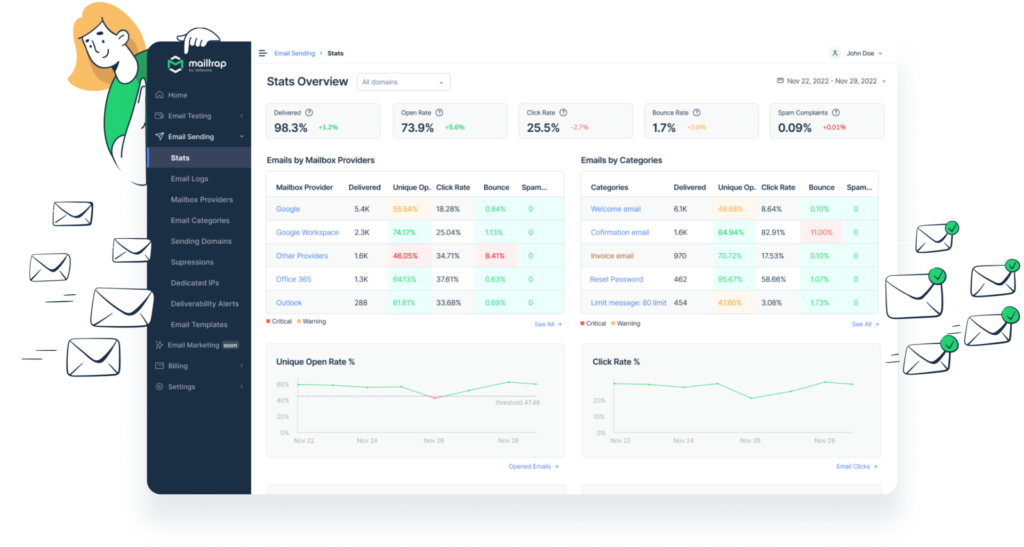

Mailtrap

Mailtrap is an email delivery platform that allows development teams and other stakeholders to test and send emails. It was first launched by the Railsware team in 2011 (more on Mailtrap’s early pricing history here).

But before we discuss how we’ve iterated on Mailtrap’s pricing model and strategy, let’s share a brief summary of how our paid plans came to be. During its first four years, Mailtrap was completely free to use. But by 2015, we had 10,000 users and it was high time to launch paid plans. Yet we had no idea where to start. At the time, there was little to no competition; our market research wasn’t super detailed or reliable. So, we turned to our users for answers.

Long story short, we ran a few dozen interviews with our customers and gathered information on how much they were willing to pay. Then we designed a survey based on our findings and invited the rest of our active users to share their opinions. Ultimately, we didn’t take full advantage of the insights we received. We launched a usage-based pricing model with three tiers and ended up charging much less than we could have.

When, how, and why we increased prices

We’ve increased Mailtrap’s prices twice in the intervening years: once in 2018, and again in 2023.

First price increase

In 2018, our software agency decided it was time to align Mailtrap pricing with the product’s actual value. In the space of three years, we had added new features, improved the UX, and expanded the team. But to avoid undercharging again, we knew we had to take a more data-driven approach to product development in general.

This time, we ran more customer interviews, created buyer personas, conducted in-depth competitor research, and analyzed the customer data we already had (how many emails they send/receive, what features they use the most, etc.) Those findings provided the basis for our 6-tier usage-based pricing model.

Each tier – Free, Individual, Team, Business, Premium, Enterprise – catered to a different segment of our audience. We set limits between 5K test emails per month (Individual plan) to 10M per month (Enterprise plan). Establishing customer cohorts allowed us to better manage our server costs and customize the plans.

Second price increase

By 2023, Mailtrap had evolved from a developer tool into a full-fledged product. It now had an extensive knowledge base, dedicated customer and onboarding support, and a bunch of new features. Our cloud infrastructure had expanded and operational costs had skyrocketed. So it was time to revise the pricing model that we hadn’t touched since 2018.

First, we tested a slight increase in prices with new customers only for one month (and just for the email testing aspect of the product). When our conversion rates didn’t drop significantly, we knew were on the right track. So we rolled out the changes for all existing customers (except some legacy users). So far, we haven’t experienced significant churn, and our MRR remains steady.

Crucially, we were honest in our communications with customers about the reasons for the change. Mailtrap is self-funded, so we needed a boost in revenue to keep delivering value to our users. It took a couple of iterations, but eventually, we polished the message and it was well-received by our customers.

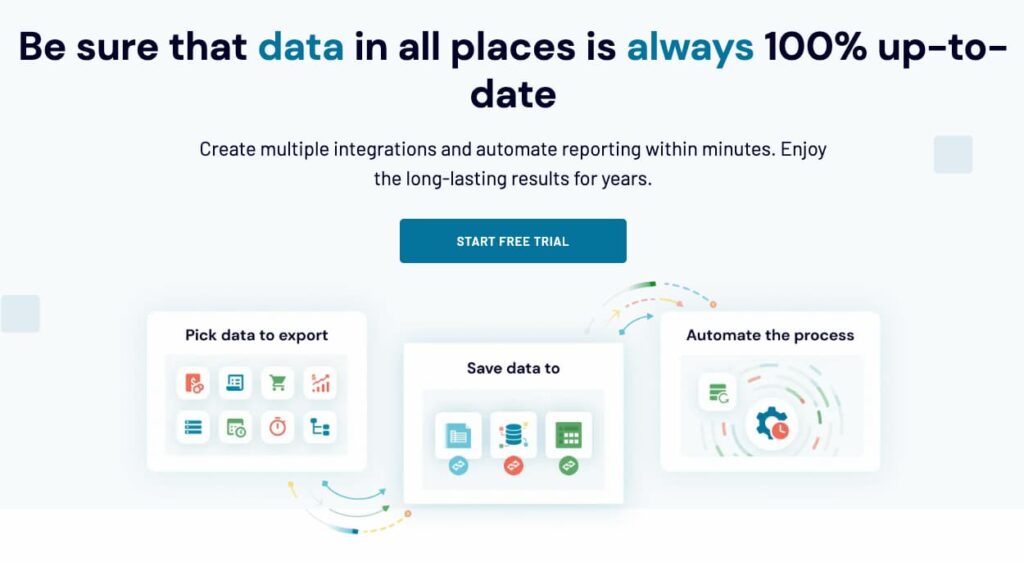

Coupler.io

Today, Coupler.io is an all-in-one data and automation platform for businesses, but it actually began as an Airtable importer and GSheets add-on. It wasn’t until it evolved into an ‘anything’ importer that we decided to release it as a standalone product in 2020. And like Mailtrap, the early version of Coupler.io was initially free to use. But at software agency we quickly learned that Coupler.io had revenue potential when it was installed more than 70K times shortly after its official launch.

We knew that a usage-based pricing model was the best choice for Coupler.io, as the entire application is built around data imports. And we originally used the cost-plus pricing strategy (on top of some competitor research) to determine the right price points. With that information, we designed 4 tiers: Free, Professional, Squad, and Business. Each tier had a limit based on ‘runs’ (manual/automatic act of moving data from a source to a destination) and ‘max import size’ per run.

When, how, and why we increased prices

By 2021, our software agency had a better understanding of our customer’s pain points, as well as how they used our product. We explored the idea of raising prices but ultimately decided to change some other aspects of our pricing model instead. User feedback told us that our limits were slightly unbalanced across the board – some customers complained that the lower plan limits were too low, while others weren’t taking full advantage of the plans they were on. So, we rejigged the limits and actually saw an increase in conversions (2% to 3.5%).

2022 price increase

By 2022, Coupler.io had changed a lot. We had improved the app functionality, developed new features, and added tons of new integrations and data sources. Not to mention, our team had grown rapidly to keep up with the product’s exponential growth. So, it was time to raise prices.

We did some in-depth customer research to determine the best way to go about it. Customer interviews were a central part of that approach – we made sure to ask potential customers what they would be willing to pay for our service. We combined that information with our own customer data and market research and decided to raise prices only for new customers. By analyzing our product dashboards, we also noticed that the freemium tier wasn’t doing us any favors, so we got rid of it.

In the end, it was a success. We saw a drop in conversion rates, but it didn’t have an impact on our MRR growth, thanks to the slightly higher price points.

Top tips for pricing B2B SaaS products

Pricing isn’t set-it-and-forget-it. There’s no golden rule for how many times you should switch up your pricing model/strategy. But one thing we’ve learned is that change is necessary, and price increases are inevitable. Operational costs rise, and to make product improvements, you need revenue. You simply have to update your pricing (up to once a year) if you want to stay competitive and grow as a company.

Communication is key. Messaging is important when informing customers of a price increase. Being too vague or flippant in your communications can damage the trust between you and your customers and even trigger unexpected churn. Oftentimes, your users just want to know the ‘why’ behind it. So, work with marketers to craft a concise and respectful message. Try using a reliable email builder that can help you design and format your message professionally, ensuring it aligns with your brand. Test your email with a small segment of your audience before sending it out to your whole customer base. And when you’ve landed on the right message, make sure to provide customers with reasonable notice – one month in advance is a good rule of thumb.

Meet your future customers halfway. It’s not always easy to attract paying customers to your product. But it’s impossible to build a loyal user base simply by running ads on social media or posting your product on app marketplaces. With Mailtrap, we gained our first wave of paying customers by engaging with our audience on Stack Overflow – and it cost us virtually nothing. Basically, you need to be proactive in how you draw potential paying customers to your product. You’ll find more tips on how to do that in our post ‘How to market a new product to get first paying customers.’

See our posts on Lean software development and SaaS product management for insight on how to build products that deliver real value to users.

What to avoid when pricing your B2B SaaS product

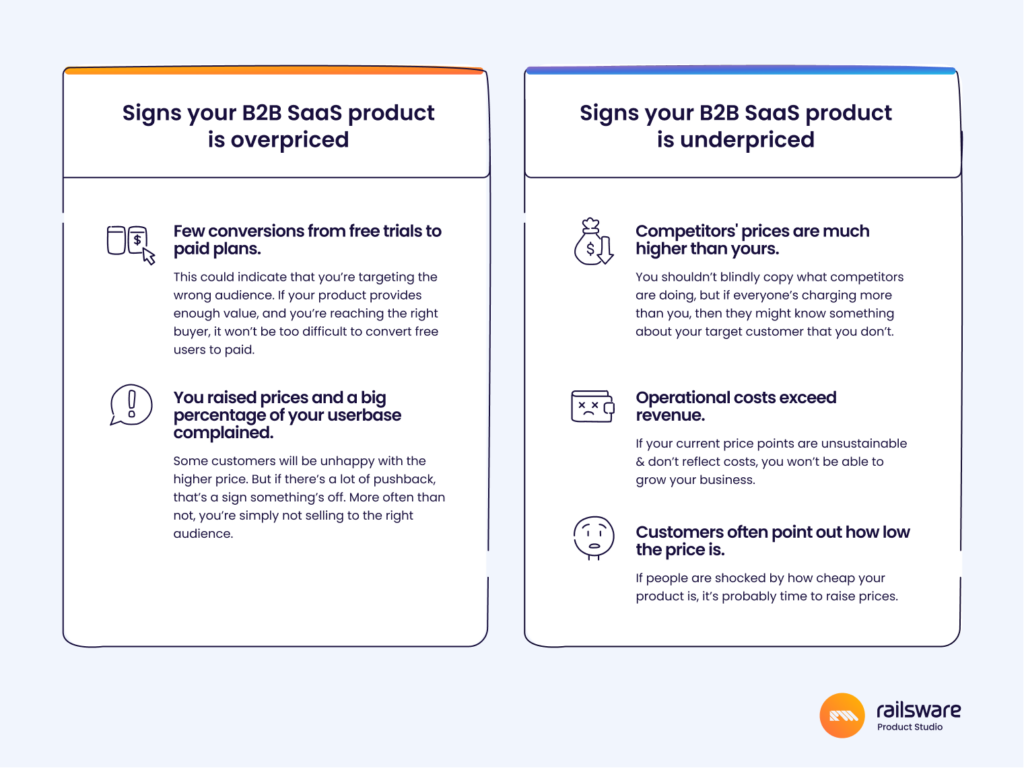

Undercharging

There’s nothing wrong with having freemium plans or offering heavy discounts to customers (especially early adopters). But don’t rely on bargain-basement prices to grow your user base. Remember that additional factors like saas sales tax compliance across multiple markets can add complexity to seemingly simple pricing strategies. And don’t underestimate your customers’ willingness to pay for something that they love.

Ultimately, you want to attract loyal customers; people who are excited about your product and who are happy to keep using it, despite its bugs or imperfections. It’s always better to have 1K active users, than 10K occasional users. Adopting the value-based pricing strategy can help you avoid the pitfall of undercharging (or not charging at all).

Overcomplicated models

The golden rule for B2B SaaS pricing? Keep it simple.

Simple doesn’t mean adopting a flat-rate pricing model even though usage-based would be a better fit. It’s about making it easy for potential customers to grasp why your solution is budget-friendly and better than market alternatives. The Younium team has created a useful guide on subscription management that can help you find out how a user-oriented pricing strategy can help you manage your subscribers and make a pricing decision. Still, our overall advice is to steer clear of unnecessary tiers, cluttered price points, and hard-to-read sales copy.

Instead, keep tiers to an absolute minimum and display prices in large, bold font. Pick one-word names for your plans (for example, Coupler.io has Starter, Squad, Business, & Enterprise). Summarize in one sentence who the plan is for (small teams, freelancers, large enterprises). Clearly state the length of the free trial (if you have one), whether or not a credit card is required, and any discounts for annual subscriptions.

To support this kind of clarity and flexibility at scale, many teams turn to SaaS billing software that simplifies plan management, automates invoicing, and ensures smooth customer experiences across different pricing models.

Not connecting with customers

Many startups don’t bother speaking to their customers before setting prices – in fact, only 6% report having done in-depth customer research. But trust us – this is a step you can’t afford to skip. As we mentioned earlier, when it comes to building high-value products, CustDev is essential.

Yes, it takes a lot of time and effort to run customer interviews, create/distribute surveys, and draw insights from the results. But there’s no substitute for direct customer feedback. Schedule interviews with potential customers/early adopters and ask hard questions like ‘How much would you be willing to pay for our current product?’ or ‘What would it take for you to be willing to pay for our product?’

Hiding prices without good reason

Nowadays, B2B SaaS buyers expect transparency and convenience when researching potential solutions. They’d rather not waste time attending consultations or demos for products that aren’t even within their budget. And while it’s true that not displaying prices prevents spooking price-sensitive buyers, pricing pages filled with CTAs like ‘Get a Quote’ or ‘Learn More’ can also scare visitors away.

Here’s when it’s a good idea to hide prices:

- Product is highly technical or offers more than one type of solution (e.g AWS)

- You want to customize plans for each user (e.g. HR & payroll software, Paylocity).

- You have a long sales cycle and tricky onboarding process (e.g Netsuite)

Psychology and B2B SaaS Pricing

So now that we’ve discussed the various models, strategies, and cases, we need to explore what actually motivates B2B buyers to make a purchase.

Let’s start with this: price points aren’t everything. Numbers on a screen – even if they’re single digit, or replaced with an all-caps FREE – aren’t enough to convince someone to do business with you. To get conversions, you need to understand how your customers make decisions.

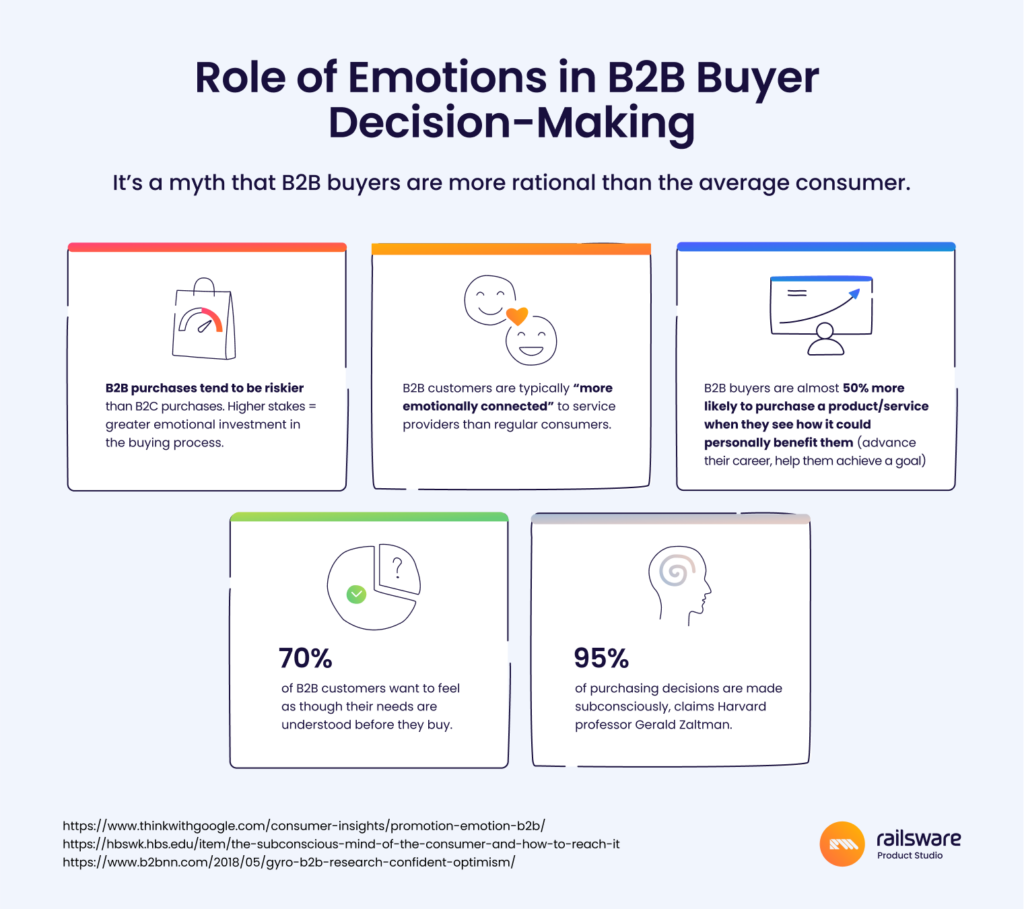

Why B2B purchasing isn’t strictly rational

We tend to assume that B2B buying decisions are driven by logic. But in reality, the B2B buying journey is rarely steered by rational thought. Humans are complicated. We’re not adept at ingesting large amounts of data, objectively weighing our options, and picking the optimal solution – at least not all of the time.

In an ideal world, customers would shop around, compare plans against their budget, consult with other stakeholders, and in the end, choose the best deal for their business. But we know it’s not that simple.

As consumers, our decisions are often influenced – even guided – by emotion. And this is especially true for B2B buyers, as a major Google, Gartner, and Motista study found.

Consider that every B2B buyer will eventually make one of four choices:

- Purchase your product

- Buy one of your competitors

- Not buy anything at all

- Decide not to decide

How do we get as many people as possible to make the first choice on that list? It starts by understanding their literal pain points.

The pain of paying

The idea that making a purchase can be painful was first proposed by Ofer Zellermayer in his 1996 thesis, The Pain of Paying. More recently, Psychology & Behavioral Economics professor, Dan Ariely, explained what the pain of paying includes in this video. Here are the key takeaways:

- The opportunity cost. When a buyer chooses one solution over another, they miss out on the benefits that the alternative solution has to offer, which can evoke feelings of loss or regret. Try highlighting your product’s benefits – how do you save your customer time/money/labor?

- A ‘hassle’ component. When signing up is too difficult, confusing, or time-consuming, potential customers typically look elsewhere for a solution. So, make sure to cut out the complexity. Ensure that your pricing is fair and the signup process is easy to navigate.

- A moral tax, with its associated guilt. We feel less guilty about buying something when we feel like we’re getting a good deal. Free trials, freemium plans, and signup discounts are a few ways to help your customers feel like they’ve bagged a bargain (but don’t lean too heavily on these tactics if you want to build a solid user base).

- Method of payment. It’s typically more ‘painful’ to pay with cash than with a credit card because the loss is more tangible. In a SaaS context, we can minimize pain even more by letting new customers signup for trials without credit cards.

- Timing of payment. Paying in advance reduces the amount of pain we feel over time because we’re not constantly reminded of our subscription costs. Try offering discounts (e.g. 20-30%) on annual plans to encourage upfront payments.

What are some other psychological tactics you can leverage when designing your pricing page and structure?

Free trials

At first glance, it might not seem like a psychological ‘hack’, but one of the reasons why free trials are so effective is because consumers are loss averse. We don’t want to lose out, even if ‘sticking around’ isn’t in our best interests. And free trials come with an expiry date, which creates a sense of urgency.

So, to really hook users, craft free trials that have some of your most coveted features built-in (not just the essentials). For example, one of the features we offer in Coupler.io’s 14-day free trial is a 15-minute data refresh schedule. To keep availing of this feature after the trial ends, you need to signup for the Business plan.

Charm pricing

If you’re not already familiar with this tactic, charm pricing is when one cent/dollar is knocked off a double-digit price in order to make the product appear less expensive. So, for example, a monthly subscription is advertised as $9.99 instead of $10. Charm pricing plays into our ‘left-digit bias’ i.e. as consumers, we tend to gravitate towards prices that end in .99.

A recent study shows that this pricing tactic is more effective when a charm price is contrasted with an ‘old’ price: e.g. was $11.99, now $9.99 (something you’ve probably seen all over Amazon.com). While charm pricing is highly effective, we still recommend doing some A/B testing to determine whether this tactic is a good fit for your product.

Social proof or the bandwagon effect

Social proof is about providing your potential customers with clues as to how popular and successful your product is. It’s based on the idea that consumers prefer to purchase products that are already widely accepted and endorsed.

Sharing customer reviews, ratings, or the number of users with your target audience are just a few ways to demonstrate social proof. We applied this tactic to Mailtrap’s pricing page by positioning a ‘Trusted by’ section directly above our list of plans. By displaying the logos of some of our biggest clients (e.g. Paypal, Adobe), we can reassure B2B buyers that Mailtrap is a credible and reliable product.

Showcasing testimonials on your pricing page is also a good way to demonstrate social proof. Just make sure the text isn’t hard to read or too long; short tweets or 1-3 sentence snippets are ideal.

Center-stage effect

The center-stage effect refers to our tendency to choose the middle option when we’re presented with a set of choices. Our eyes are naturally drawn to the center of a page and we don’t like to pick something that’s too cheap, or too expensive.

The idea is to offer a plan that’s ‘just right’ for a large segment of your users. It needs to have a fair price – one that strikes a balance between your other plans (even if you have more than 3 tiers, you can still take advantage of this tactic). To leverage the center-stage effect in SaaS pricing, use visual cues to highlight the best plan e.g. frames, colors, or attached banners with phrases like ‘Most Popular’ or ‘Recommended.’

Wrapping Up

Instead of a conclusion, we offer a vetted list of research on SaaS pricing relevant in 2023:

- Usage-based pricing is the most popular pricing model in 2023.

- 1 year is the average contract length and average billing frequency for SaaS companies.

- 7-day free trials are best for maximizing ‘customer acquisition, retention, and profitability,’ according to a 2021 study.

- It’s outdated to ask for credit card details during a free trial or freemium signup.